5 Things You Must Know When Starting to Trade Forex

Before your mind leaps instantly to the image of the Wolf of Wall Street, the financial currents of the world are slowly shifting to embrace a new way of investing: forex trading. The essence of this system is that you gain access to a trading platform online where you can invest in foreign currencies, but since the competition is getting fiercer in the last several years, it’s not a game for the faint of heart.

On the contrary, it takes skill, knowledge, and a distinct ability to understand the intricacies of the foreign exchange market, in order not just to earn a decent sum, but also to avoid massive losses. So, before you take the leap into this fast-growing network of traders, take a look at a few essential tips you should keep in mind in order to make the most of your efforts and lower the risk of losses.

1. Discipline before emotions

Unless your primary occupation is that of a yoga instructor, there is bound to be tension in every field of work out there, and trading is no exception. However, a lot is at stake in the forex market, and being guided by your gut or your mood may only lead to lucky wins that result in too much confidence, or poor decision-making, which equals financial loss.

Despite the fact that many, if not all of your initial investment choices will be based more on luck and hunches than actual expertise, you still need to learn how to be patient and disciplined from the earliest days. There will be tempting moments when you will want to go all in, but the perks of long-term success should teach you when to steer clear and wait for a better opportunity. You might be forced to skip a few trading chances, but that means that you are learning to recognize safer, more promising opportunities in the market.

2. Go at it alone

Beginners in this investment field may be tempted to start with a partner, whether it’s a friend, a family member, or a close acquaintance, but the risks may outweigh the benefits. If you feel that two minds are better than one at analyzing the state of the market and foreseeing changes in the currencies you wish to trade in, think again.

Inexperience in both may lead to poor decisions, in which case you will likely end up blaming your partner for the missed opportunity, and vice versa. There is always a certain level of risk involved in this business, so you need to learn to be responsible for your own decisions, while avoiding a potential rift between you and your loved ones for the sake of a risky investment decision. Yes, that means that you need to think through your strategy on your own, but at least you will keep your relationships intact.

3. Do not invest what you do not have

Even some of the most experienced and well-versed traders know when not to “over-invest” in a currency that seems to be blooming at a given moment. Especially if you have had a few lucky strikes in the trade game since your beginning, you’ll possibly want to increase the profit by investing more than your standard 1% of your net worth.

However, making such massive investments comes with equally substantial risks, and you need a reputable forex broker to boost your chances of trading success. The market is incredibly competitive, and the number of available brokers is growing, so you need to find someone you can trust, rely on their advice and guidance, and who will have your best interest at heart.

4. Everything happens online

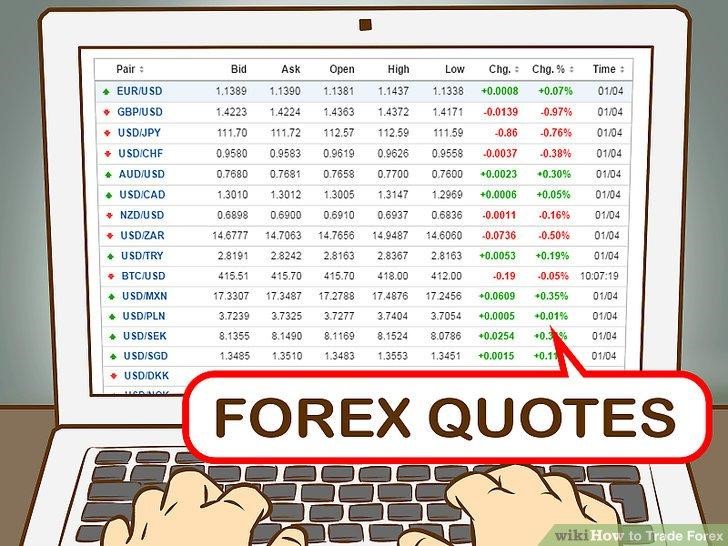

If you are familiar with the stock market, where investing into a company means that you become a partial owner of said company, you might have similar ideas when it comes to the forex market. However, the reality in this scenario is quite different, since you actually don’t own anything that is being traded, including the currencies that you’re investing in.

Your broker is responsible for recording your investments, losses, and profits, but since everything is done electronically, so there is nothing “physical” for you to own. Forex market is a spot market, meaning that all trades happen immediately without delay, so in case you earn a profit from a trade, it will be added to your existing value, while losses will be deducted.

5. Understand your mindset

When you find yourself experiencing major wins in the early stages of your trading career, you will likely feel bolder than you should be, just like a few initial losses will give you a greater sense of unease when you need to evaluate the level of your upcoming risk. It’s simply human nature, but the result will be that in the former situation, you might actually take a greater risk and lose much more, while in the latter, you might find yourself missing out on a perfectly viable opportunity due to overwhelming fear.

It takes ample experience, analytic and otherwise, to assess these situations realistically, so that you can “override” this basic human instinct and base your trading calls on actual facts, and your broker’s guidance.